Role of Finance in Business Management

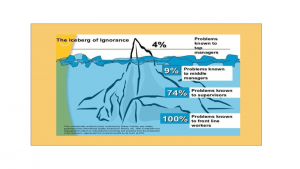

Extreme speed of globalization, availability of huge data and tools and customer rights, environmental sensitivity, sustainable business growth and work force trends and preferences necessitate the establishment of a very strong finance function.

Mastery of the financial principles and decisions by the senior business management and financial assurance of right business decisions are now crucial for the shareholders, investors, employees and customers to make financially sound and well managed corporate decisions.

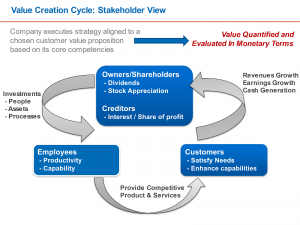

With understanding and utilization of the basic financial planning and reporting principles and tools, corporate leadership can better plan and manage the profitability, solvency, efficiency, risk and overall performance of their organizations and thus satisfy the requirements of their key stakeholders.

- Financial reporting should provide information that is useful to, current and potential, investors and creditors and other users in making rational investment decisions

- The information should be comprehensive to those who have a reasonable understanding of business and economic activities and are willing to study the information with reasonable diligence.

The information should reflect a true and fair value of the company activities

Finance therefore fulfils two roles:

- Compliance/Fiduciary Duty

- Transparency to investors

- Legal, Regulatory and Tax compliance in jurisdictions the company operate in

- Record keeping

- Business Support

- Translate strategy into financial goals

- Financial budget planning & forecasting

- Support management decision and control

- Management Reporting

- Ad-hoc analysis of resource allocation proposals

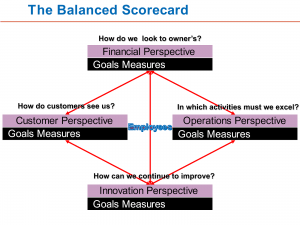

For the Business Support role, finance is one of the four key set

of business fundamentals in the Balance Scorecard:

In cooperation with KnowledgeTrack, Swiss Business Institute Sarl will deliver a one-hour free webinar on january 28th, at masteringknowledge.com in advance of a 2 full day live on-line training

This free webinar will help you to:

- Emphasize the criticality of using the same language in finance

- Understand basic concepts and terminology of accounting and finance

- Become familiar with basic financial statements

- Be able to use analysis tools in evaluating financial performance and investment proposals

- Better understand financial implications of business decisions

- Improve and master financial planning process for business

This course is developed to equip non-finance corporate leadership with the required financial concepts, tools and techniques through a model of seminar, pre- and post-training reading and assignments and exercises.